It seems like the crypto currency bubble has popped. Over the last 24 hours the market has gone down about 20% to 30%. China is steering to an outright ban on trading and South Korea is also clamping down. This is terrible news for people who are stuck with bags of coins but great news for gamers as it could mean that we will see a decline in demand for gpu's by miners. I expect Ethereum will be under heavy downward pressure for the near future so maybe soon we'll see a influx of unsold GPU's as well.

Good news for people who want to buy a GPU. The Crypto bubble has popped.

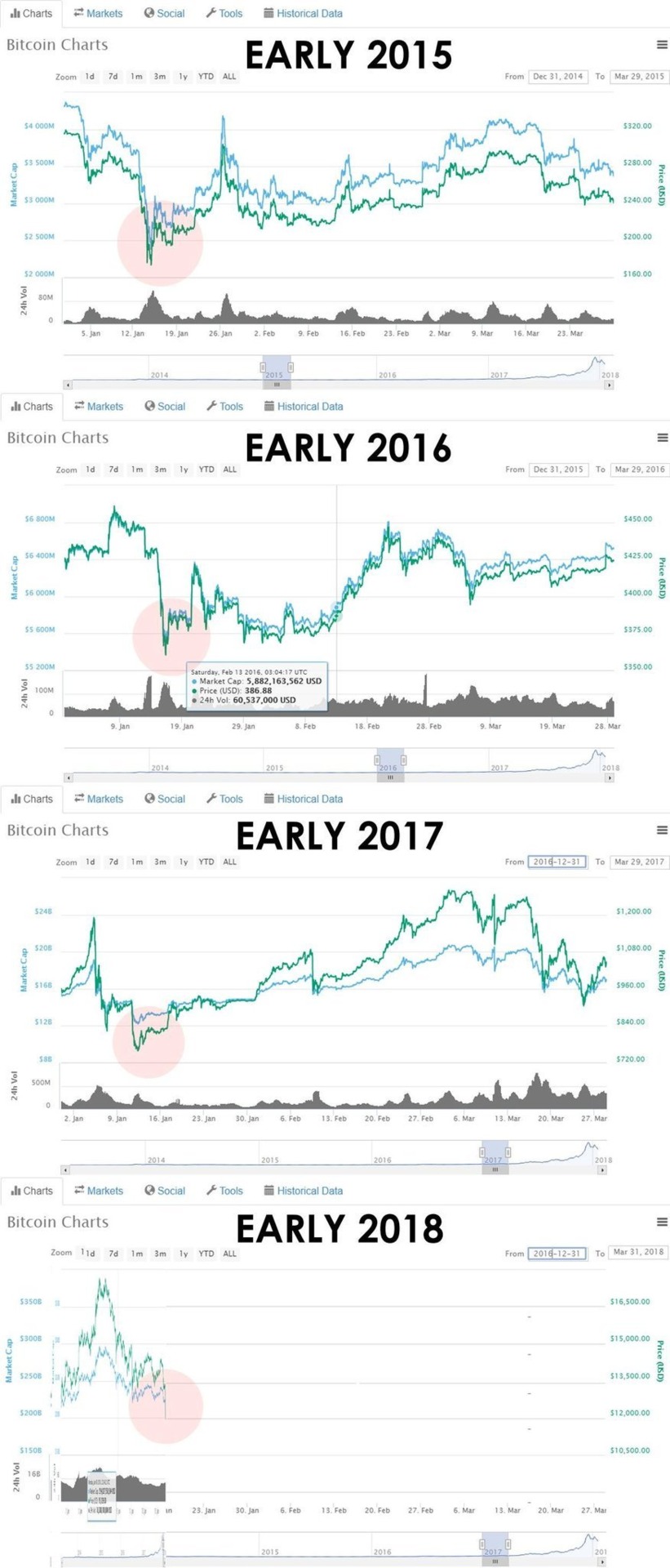

I don't know man, that looks like a regular spasm of the crypto market. Bitcoin lost more than 50% value a few weeks back and got back 30-40% in the following weeks. Now it's down 20% again. Sounds like business as usual.

@pyrodactyl: Well the thing is that this time it is a bit of a perfect storm for a major crash.

until it's officially backed by some sorta government i would have cashed out as soon as it hit like 10g(probably would have cashed out at 5 lol). It's just way to volatile and confusing for me, but props to anyone who stuck with it and made or will make money off it.

And it won't really affect the price on gpu's right away, but you may find a few second hand for a decent price after a while if/when the drop seems to stick.

The bubble hasn't popped. They've all lost value, but they are still worth quite a lot. The bubble bursting would mean they lost like 90%+ of their value or there was some technical flaw found that made it possible to cheat the system. As long as it's possible to make money with GPUs the prices aren't going to come down significantly. Since many places in the world have very cheap electricity, it would take a major crash in value to make mining unprofitable. Unfortunately, we'll probably have to wait for the major coins to move to a proof-of-stake system before we see GPU prices get back to normal.

Yeah, a 30-40% drop sounds normal and isn't likely to have any major impact on crypto currency or GPUs. It would need to seriously tank and completely destabilize before I'd get my hopes up that this crypto currency shit might finally go away.

Seems more like the type of rapid volatility that's par for the course for cryptocurrencies, rather than a bubble pop or a crash.

@flasaltine: you can still mine some smaller stuff and big miners like to buy gpus in bulk for sli builds etc.

@flasaltine: Only for Bitcoin, almost everything else can still be mined profitably with a GPU.

It seems like the crypto currency bubble has popped. Over the last 24 hours the market has gone down about 20% to 30%. China is steering to an outright ban on trading and South Korea is also clamping down. This is terrible news for people who are stuck with bags of coins but great news for gamers as it could mean that we will see a decline in demand for gpu's by miners. I expect Ethereum will be under heavy downward pressure for the near future so maybe soon we'll see a influx of unsold GPU's as well.

This happens every few months, lol.

For perspective, around November time, Bitcoin tanked from $6500 to $3000. In December? Bitcoin hit $20,000.

This is terrible news for people who are stuck with bags of coins but great news for gamers as it could mean that we will see a decline in demand for gpu's by miners. I expect Ethereum will be under heavy downward pressure for the near future so maybe soon we'll see a influx of unsold GPU's as well.

I'd bet money my bags of coins will be worth triple their current value by August 2018. Nobody is going to sell their entire mining setup because of a few weeks of turbulence.

Ethereum isn't the reason Nvidia cards are selling out instantly as Nvidia are so-so at mining Ethereum.

Until stores start enforcing limited quantities (which are easy to get around) I'm not sure what the solution to this is. It's hard for Nvidia to cripple cards for mining (and affects their bottom line) because many mining algorithms scale directly with the amount of CUDA cores, thus the better the gaming card, the better it can hash.

Isn't this a yearly occurrence?

What's really fascinating is how many people are getting screwed on this ride. There was an article about how a good deal of recent inflation was due to a pump 'n' dump, that then spiraled out of control when people saw the prices rise and egged everyone else to get into crypto around December. Then some market shut down and kept most all of the money. This is basically what an unregulated stock market would look like. Or the return of penny-stocks.

Isn't this a yearly occurrence?

What's really fascinating is how many people are getting screwed on this ride. There was an article about how a good deal of recent inflation was due to a pump 'n' dump, that then spiraled out of control when people saw the prices rise and egged everyone else to get into crypto around December. Then some market shut down and kept most all of the money. This is basically what an unregulated stock market would look like. Or the return of penny-stocks.

I'm not too sure what you are referring to but in December a lot of people hyped up Ripple (XRP) and told their friends to take up loans, expecting to make 3x or more their investment.

Here's where the problem is: Ripple has so many XRP coins in circulation, which means the price per coin is going to be lower and the market cap has to increase significantly to see large returns if you're buying in at a high price. People took loans out and bought in at the highest point and got screwed.

A fool and his money...

Ripple is very sketchy in my opinion as they have a lot of XRP coins locked away waiting to be unleashed on the market which would tank the price down, apparently they will release these coins if the price of XRP becomes too high inconveniencing bank transfers.

I wouldn't touch Ripple with a 10 foot pole. Saying that, you never truly lose money until you sell at a loss and pull it back out into USD or whatever currency, it's certainly possible XRP will get back to the price it was last month at some point.

until it's officially backed by some sorta government i would have cashed out as soon as it hit like 10g(probably would have cashed out at 5 lol). It's just way to volatile and confusing for me, but props to anyone who stuck with it and made or will make money off it.

And it won't really affect the price on gpu's right away, but you may find a few second hand for a decent price after a while if/when the drop seems to stick.

Price of GPUs isn't the bigger problem, stock is the bigger problem. In some parts of the world it's impossible to even find anything past a 1050 or a low end 1060 to buy because mining operators would buy up all the stock they could.

Also I wouldn't buy a second hand card that someone was using for mining considering they'd have been running at 80-100% performance for 24 hours a day, 7 days a week.

And as @darlingdixie says - nobody serious about this is going to offload their mining rig because of a little turbulence in the market.

Price of ethereum is still higher than it was 3 weeks ago. Itll go back up soon, this always happens.

I think a lot of people are underestimating the situation that is unfolding in the crypto space at the moment. Sure, things will turn around at some point but it's a long way down until then. Now the question is were will it bottom out exactly and that is up in the air. If the chart follows the typical bubble pattern (which it is at the moment) it might test 1k but there might be some support at 7k. There isn't a single coin out there that has a solid foundation. The cry for regulation will only get stronger now that media attention is involved as well. There are a lot of questionable practices that have to stop before the industry can be taken seriously (price manipulation, pump and dump groups...). At the moment it's a speculator driven bonanza with camps of zealots trowing claims of scams to other players in the market on a constant basis. The technology also still has a long way to go as well to become a usable and sustainable. People are sometimes blinded by all the big partnerships that are announced to validate the big valuations. Microsoft is on board with about every coin under the sun for instance, so are many banks. But it is questionable how much faith those companies really have in the technology and how many are just hedging their bets. If you want to inform yourself about crypto it is important to not only go to places were the cheer leading is going on. It might save you a lot of money.

A ton of people bought in high with money they didn't really have to invest/gamble. They freaked out during the normal January dip and started a chain reaction of pulling out. This "crash" isn't any more unusual than what we've seen at the start of every year.

Everyone forgets about the gains when there is a major correction. Bitcoin was $900 on this day last year (over $10k as of this comment). Ripple was less than a penny at the same time ($1.06 right now). Ethererum was $9.85 (now $895). It would be insane to expect no correction on this.

I expect the GPU market to stay on fire for a while. The problem isn't magically fixed with the normal crypto volatility. It's more popular now, so there is more coverage (and more doomsday headlines).

Didn't GPU mining die a long time ago?

Only for Bitcoin, more or less. On some coins (e.g. Monero), you can even get a meaningful amount out of CPU mining (due to a different proof-of-work algorithm IIRC).

having actually just ordered at 1080ti, by which I mean 'pre-ordered' I can tell you the supply chain is still pretty slow, It won't be available till next month.

I won't believe it until I see bitcoin back below 1000. People will still continue to ride this batshit crazy roller coaster of volatility

I feel like this is another boat I have missed. I'll read up on it, but honestly how much profit can you make, and is it worth the trouble? I also get the impression this stuff is squarely in the camp of hacker/programmer/hardware wizards who continue to make me feel horribly inadequate in my field of employment every single goddamn day. Again I will read into it more as I haven't followed it closely, just venting.

One thing for sure is people couldn't ask for a better time to put a bit of money into a cryptocurrency, everything is 'on sale'.

I have to wait for a refund on something before I can do it but I'm thinking of dropping $1500 or so on Ethereum this week, hopefully the price goes down even more before I buy!

I feel like this is another boat I have missed.

Almost certainly you and everyone else jumping in now has missed the boat. The time to buy was years ago either when it first started or after the first really big scare when MtGox went away and people lost potential millions, back when you could buy BTC for single digit amounts. Back when you could maybe actually own a whole 1 BTC instead of 0.019 of a BTC.

I know a guy who got caught up in the MtGox thing. He lost 100 BTC (now valued at just under $1M). He got some of those for free and bought the rest for $50.

I feel like this is another boat I have missed.

Almost certainly you and everyone else jumping in now has missed the boat. The time to buy was years ago either when it first started or after the first really big scare when MtGox went away and people lost potential millions, back when you could buy BTC for single digit amounts. Back when you could maybe actually own a whole 1 BTC instead of 0.019 of a BTC.

I know a guy who got caught up in the MtGox thing. He lost 100 BTC (now valued at just under $1M). He got some of those for free and bought the rest for $50.

I think it's still crazy early in the space but yeah you just won't get rich from dropping $100, unless you gamble on ICOs and one of them goes crazy.

@darlingdixie: I put $100 in back when it reached about 5k per BTC. I got that $100 back out as Steam credit, on the very day Steam announced they'd stop accepting BTC. Since then I've just let the rest ride and I'll see where it ends up.

@darlingdixie: I put $100 in back when it reached about 5k per BTC. I got that $100 back out as Steam credit, on the very day Steam announced they'd stop accepting BTC. Since then I've just let the rest ride and I'll see where it ends up.

Even if things go truly catastrophic, we have wonderful memes.

Thank goodness. I want all this crypo speculation crap to die. Bitcoin is an awful investment seeing how it has zero fundamental value. It was never intended to be used this way.

Thank goodness.

Nothing happened. Prices are already going back up.

+$100bn in the last 24 hours

@fnrslvr: That's probably still way more than what most people paid for their Bitcoins or what they invested to mine. Anyone who's been in Bitcoin for any length of time has seen these sort of drops before and know it could just as easily swing back to an even more ridiculous high in a few months. Until it drops to just a couple hundred bucks and the whole damn thing collapses, Bitcoin isn't going anywhere.

@cursethesemetalhands: fwiw, mining doesn't look all that great at the moment. Based on some quick numbers I punched into a profitability calculator, you stand to make something like $20 per month per 1070 at current prices, which obviously makes buying new hardware unviable. As for what most speculators paid for their coins, I imagine there are a lot of recent speculators who are feeling pretty burned right now, though I can't speak to numbers.

You're not going to get a firm bet from me about how this is going to shake out. Between the massive influx of novice speculators with no idea how to valuate a currency, opportunistically jumping on and off the bandwagon, throwing the market out of whack, and clogging up the ledgers while they're at it; all the organizations moving to ban and/or regulate cryptocurrency transactions in various ways; and big risk factors like the Tether situation, I think making sound predictions about where prices are going to land long term is really hard.

It seems like the crypto currency bubble has popped. Over the last 24 hours the market has gone down about 20% to 30%. China is steering to an outright ban on trading and South Korea is also clamping down. This is terrible news for people who are stuck with bags of coins but great news for gamers as it could mean that we will see a decline in demand for gpu's by miners. I expect Ethereum will be under heavy downward pressure for the near future so maybe soon we'll see a influx of unsold GPU's as well.

South Korea didn't ban anything

People claim it dead all the time, from my understanding it jumps up and down raipidly all the time.

My bank just banned cryptocurrency purchases on their credit cards. I have a debit card, so it doesn't affect me, but I'm not sure how to feel about the decision. Like, I get that they don't want people defaulting on credit because people who don't understand the volatility of the market lost money on crypto, and there's something about crypto that I find quite off-putting and dysfunctional (not an economist, so I don't pretend to fully understand it). But it's a bit of a slippery slope trying to regulate what people can and can't spend their own money on. They wouldn't stop people from gambling or other irresponsible things, so what makes crypto different? I feel like it's the role of government to make these kinds of policy decisions, not banks.

I bought my new PC with a GTX 1070 TI on Cyber Monday, just before the prices of cards went through the roof, so I definitely dodged a bullet there.

So things are still looking pretty bleak for crypto at the moment. The biggest worry is Tether which is a coin that is supposed to be a a stable 1$ value all the time. A lot of big exchanges use tether as a base to trade against. But recent news is that Thether may have been involved in some major market manipulation and are under subpoena now. If this coin goes under a the aforementioned exchanges may be in danger so a lot of people have pulled their money. The recent stock exchange downturn might bring in money though as crypto has been used as a "safe haven" before. With BTC around 7k we might see a consolidation and some relief rallies but it is impossible to say if they will hold.

I think the mining craze is going to die down more in the next months. We will have to see a major reversal in the markets before we'll see big investments in mining farms IMO. So gamers looking to buy a GPU may get some better prices at last. Fingers crossed!

@bdead: Gamers might get some better prices if they're looking to buy some used cards, but it's unlikely to have a big impact on new cards.

People like to point fingers at miners, but the bigger culprit on the recent price hikes have been memory costs. Vendors right now are paying way more for GDDR5 than they used to.

Even just looking at the set of DDR4 RAM in my pc, it has doubled in price since last year.

@aktivity: I think its a combination of the two: miners and memory prices driving up the cost of GPUs. Yes memory has obviously been way higher and that is affecting it to an extent, but the fact that miners have been buying up every card the moment they get in stock has been hugely affecting availability for gamers and thus driving the price up.

Also, my personal opinion is to be wary of used cards. I know its probably "safe" if you do your due diligence, but I'm always worried someone didn't care for it as well as I would have. Nor do I have anyway to verify how long was it actually used for and how it was used.

@maxszy: I agree that miners do have an impact on availability, I just don't think their effect on pricing is as great as some seem to believe. I'm talking first-party vendors, rather than third-party's selling a handful of cards for ridiculous prices.

As for used cards, my current card is the first card in a decade I bought new. Most of my upgrades through passed years have been used parts. If you're critical when choosing a seller you can lower the risks and I generally restrict my purchases to sellers within reasonable distance of my location.

It feels like everyone's making a bigger deal of things than they really are at the moment. Yeah, the prices of crypto have gone down by between 50-80% in the last couple of weeks, but compared to one year ago where Bitcoin was $1000 and Litecoin was $3.80, I'd say crypto is still doing really well, and the only one who are in serious trouble and kicking up a huge fuss right now are those who jumped onto the December hype, buying in at extremely high prices, taking loans or dumping their life savings just because they heard a couple of rumours or read a couple of 'new articles'

Also remember there's a ton of lag with supply chains - even if all cryptocurrency were outlawed tomorrow, it would probably take weeks for stock to come back in and prices to adjust (as stores realized that people aren't going to pay double MSRP for 1080Ti's anymore.)

In order for the graphic card market to return to "normal" levels, cryptocurrency prices have to drop significantly, and stay there for months. Only then will miners will stop paying exorbitant prices for cards because at a sustained lower price, it's not worth it to build massive mining rigs anymore.

Please Log In to post.

Log in to comment