Loom Band Valentine Printables

If you’re the mama of a school age kid, you’ll have seen their wrists and backpacks decked out in Loom Bands! I happen to have a 10, 9 and 7 year old who are LOOM FREAKS! My awesome sister in law Kristin brought the bands to our family Thanksgiving trip and it kept them busy for H O U R S. I thought surely my daughter would be the only fan but my two boys (the 9 and 7 year old) were fish-tailing bracelets without the loom by the end of the weekend. My nearly 11 year old is now selling her creations and doesn’t use the loom much since she’s becoming a pro. Plus, it helps with their fine motor skills so that’s a huge bonus. I thought it’d be fun to make some Loom Band Valentine Printables since my daughter made one for each kiddo in her class for Valentine’s Day next month. She’s so excited to hand them out to her schoolmates.

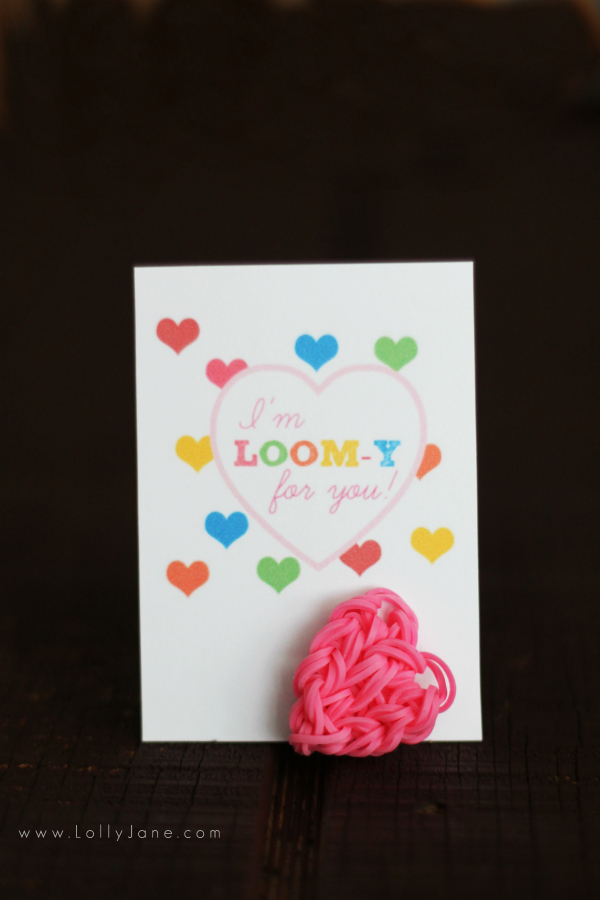

She made hearts for the girls and bracelets for the boys.

When she made the hearts, I told her they’d be great Valentines for school friends which sparked me making printables. She immediately started making the hearts in different colors. Her pals can loop a key ring through them and they become charms to attach to their backpacks. Adorable! {{{Link to make heart looms!}}}

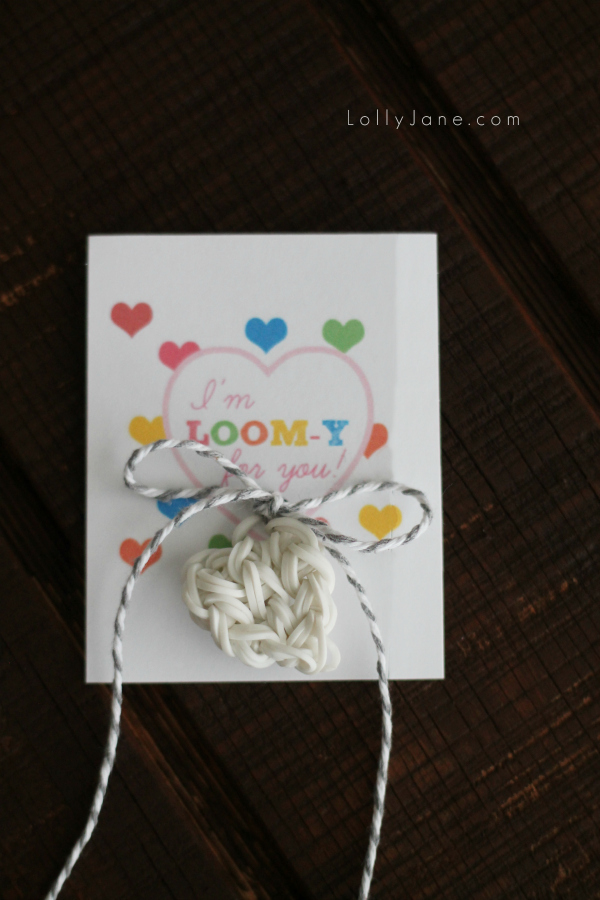

Purple: I just tied it with bakers twine a bunch of times with a knot in the back.

White: I hole-punched a hole through the bottom of the card (under “for you”) then taped bakers twine onto the back, looped both ends through the front and tied it to a corner of the heart.

Pink: I tied the bakers twine around a few times with a knot + bow in the front.

And for the boys, just wrap a bracelet around the bottom of the card.

So fun, huh?? My kids (girl, boy, boy) are each SO excited to give them out to their friends!!

{{{Download the girl card | Download the boy card}}}

Are you new to Loom Bands? We’ve rounded up some fun tutorials around the web for you so your kiddo can have as much fun as ours are!

Rainbow Loom 101 for Parents |Tampa Bay Moms Blog

Homemade Loom |Maya*Made

10 Rainbow Loom tutorials |Kids Activity Blog

9 Loom tutorials |U Create

100+ Rainbow Loom Tutorials |Loom Love

Spiderman Loom |Made by Mommy

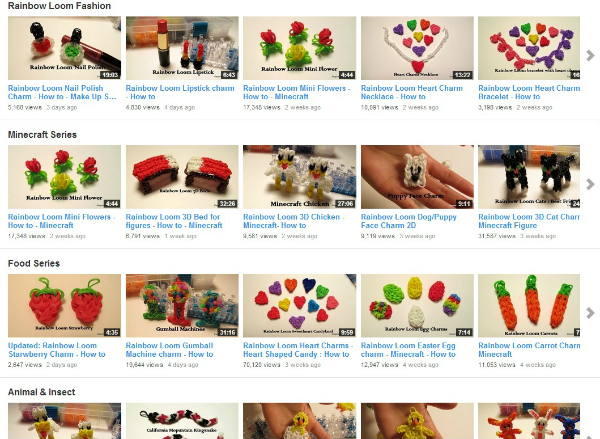

Plus I told my daughter I would share her most favorite You Tube teacher, Elegant Fashion 360. She’s got hundreds of video tutorials, here’s a quick peek below.

Check out all of our kids crafts and also our pin board full of more kid craft ideas!

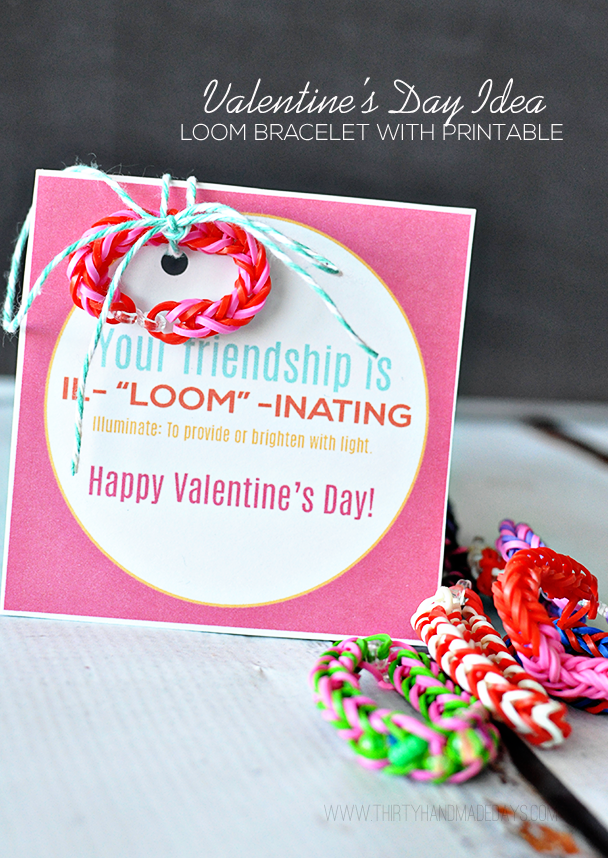

PS: Looking for more Loom Valentine tag ideas?? We thought we were the originals coming up with loom band Valentine’s, but our good friends Becca and Mique have just shared THEIR interpretations too. Take your pick!

Your friendship is Il-LOOM-inating |30 Handmade Days

It’s no STRETCH being your friend. |The Crafted Sparrow

I’m so glad WEAVE become friends. |The Crafted Sparrow

We just printed on cardstock. You can use photo paper for a sheen if you prefer that look. (; Glad she is excited! Have fun!

Thank you! Last question: what kind of paper did you use? My daughter is so excited about this..we have to get started ! 🙂

Hi Rosi, yes! Size your own (:

i, Im having a hard time printing a small size…I get the full page printed . Am I supposed to size it myself?? Thanks! Great idea btw

Thanks, Emily! XO

Sounds great! Good luck with your blog!

What adorable Valentine printables and great loom band tutorials! I’ve just started a new blog and am wanting to do a Valentine roundup. Would you mind if I include these?

Thanks!

Christie

Hi there, Kristi and Kelli! I’m the new editor of AllFreeKidsCrafts.com, and I just wanted to drop a note to let you know that I linked to your tutorial 🙂 I know we’ve worked with you in the past, so I hope you see lots of visitors from my site! My readers love all things rainbow loom, so I’m sure they’ll love these. Have a great day!

My six year old loves them too after being introduced to them by his older cousin… unfortunately the fine motor are still developing and he needs a fair bit of assistance (read: I often have to make most of the bracelet). But I bet he would love to give them out as Valentines to his class- thanks for the amazing idea!! Pinning:)

Great minds think alike (;

I love you girls! Yours turned out so cute! Thanks for linking to mine too! Love ya guys!

Oh my, loved YOUR post, Calley!! So great for newbies!! XO

Well thank you, LA!! They are actually really fun to make, lol!!

So I don’t have school age kids at my house but I may just have to go out and buy one of these looms for myself! Looks like so much fun and your printable is darling!

Thanks so much for the mention and link! What a great collection of Valentine’s Day ideas!! I may have to get the kids working on these now so they will be ready for V-Day!!